Introduction

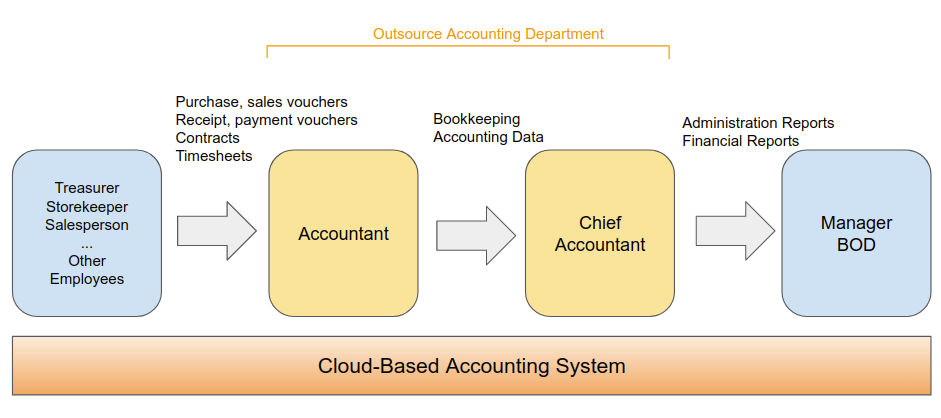

TOPA is an all-in-one accounting solution developed by Dong Hanh Technology with 8 years in the field of financial & accounting for SMEs. TOPA solution is a combination of 2 parts: Accounting Services by experts and Cloud-Based Accounting System. Our mission is becoming a professional, efficient and cost-saving outsourcing accounting department for customers.

Details scope of the service

- Create entries into accounting workbooks from purchasing, sales vouchers

- Create entries into accounting workbooks from receipt, payment vouchers

- Accounting Systems Set-up

- Calculating depreciation of fixed assets, allocation of tools and instruments

- Calculate the price of items in stocks

- Set payroll, calculate employees salary, internal accounting

- Calculating cost of goods sold, production cost

- Perform reduction, declaration of insurance for employees

- Perform TAX procedures

- Perform VAT invoice procedures

- Tasks about VAT: Collect and issue VAT invoices; Create & submit the VAT report; VAT Invoice Usage report

- Create & submit reports about: Import tax, Export tax, Special consumption tax, Natural resource tax, Land & housing tax, land rental charges, Other taxes

- Calcuate and make reports of Personal Income Tax for all employees

- Prepare annual financial statements, calculate Corporate Income Tax

- Other taxation tasks: tax refund, tax extension, tax exemption

- Prepare management reports: Revenue, cost, lost-profit, stock, payable, receivable

- Prepare financial statements: Balance sheet; Lost-profit report; Cash flows; Details of the financial statement

- Analyze financial statements and give advice to business owners

- Control and check accounting data with actual documents

- Explanation of accounting records with auditors and tax authorities

Deployment model

Frequently Asked Questions

No. All accouting tasks are in the scope of our service. However, your business should have employees to coordinate and provide data for TOPA’s accountants. These are the positions of the treasurer, storekeeper; salesperson.

No. All tasks are completed online via TOPA accouting software except tasks that are required to be done directly, such as prepare documents which requires company seals, director signatures or check,arrange vouchers periodically.

Sure. All tasks about tax and employee insurance are in service’s scope.

There are some ways to provide TOPA accountants with this information

- Use your phone to take photos of documents, vouchers and upload them to the accounting software

- Use input forms to submit this information directly on the accounting software

- For bank transactions: periodically upload bank statements of your company