VIETNAM COMPANY SETUP SERVICE

Vietnam is a well-development country at present. Along with that, a lot of foreign investor want to setup a company in our country. With many policies to support foreign businesses, this is the best time for you. However, getting into Vietnam professional market always needs a start. That is business / company establishment.

BENEFITS OF BUSINESS ESTABLISHMENT IN VIETNAM

Business establishment is the first-step to trading in Vietnam. So with a Business, you can do a lot of think:

- Have legal Status after establishment. Business can sign contract & trading with customer. With the responsibility of Legal status, it will bring more trust for customers/ partners.

- Use the investment capital to gain profit legally

- Use business to make process of import/export goods,, machines… It’s very important with all FDI Companies

- Make invoices for Customers. This is one of the most important for business in Vietnam.

- Access to loans money when you want to expand your business.

- Receive many incentives & Support from the state for foreign businesses ( Tax, custom procedures…)

- Easy to Brand – Marketing & Recruitment employee

WHY DO YOU NEED TO USE COMPANY SETUP SERVICE IN VIETNAM

Process to make a company in VietNam

For making a company in Vietnam, the investors need to accept of 3 big certificate & license

- Apply for an Investment Registration Certificate ( IRC)

- Apply for an Enterprise Registration Certificate ( ERC)

- Apply for a business sub-license for a direct-to-consumer retail company, a license to establish a retail establishment or a specialized license of the Ministry according to specific fields of activity such as: Training, Travel , Auditing, Legal, Health….

For first step, investors need to prepare some documents:

- Document of Proposal for Investment implementation

- Proposal on Investment project;

- Proposal to rental land ( If need)

- If the project uses a technology onof technologies restricted from Transfer List. You need to submit explanation for the use of the technology.

For Second Step, investors need to prepare some document

- Application form for Business registration.

- Business regulations;

- List of members, for two-member limited liability companies or list of founding shareholders, for joint-stock companies;

- Certified copy of one of the personal identification

- Capital contribution decision, Document on appointment of authorized representative for company members, institutional shareholders of the company

- Other documents in special cases

For Third step, Depending on the business line there will be different procedures. This should get advice from an expert, if the business wants to find out before investing.

Because of that, the process to start company in Vietnam is not easy, so the advice for Company is: Use Vietnam Company Setup Service

Compare business types in Vietnam

| LLC | JSC | RO | BO | |

| Nature | Easier way to start a businessIdeal for smaller businessesProtection of personal assetsShareholder’s liability: limited to shares | Ideal for medium and large businessesAllows owners to issue shares and be listed on the public stock exchangeIts charter capital assigned to equal portions of shares | Easy to set up Allow a business to gain a presence in the market before setting up a limited liability companyNot allowed to conduct any business activities that generate income and behave like an ordinary company. | Extension of parent companyCan conduct commercial activities and make profits without incorporating a separate legal entity |

| Structure | 1 shareholder (can start a single-member LLC)2 – 50 members can own multi-member LLC | 3 shareholders (minimum)No maximum number of shareholders | No need for any shareholder(s)Local representatives (foreign/local) are sufficient | No need for any shareholder(s)Smaller divisions are commonly found: marketing, finance, human resources, etc. |

| Capitalisation | Capital not stipulatedUSD 10,000: common, sufficient capital | Initial capital not further stipulatedIf so, VND 10B is required | No capital requirements | No capital requirements |

| Benefits | Liability limited to charter capitalCuts down process and operation paperworkContinues to exist even in the event of the death of a shareholder/shareholdersEasier to raise capital via angel investors, venture capitalists or other financial institutionsUsed to avoid double taxingHelps to present business as more credible due to its high transparency | Shareholders are only liable for loss or debts that will not exceed the amount of investment they have contributedShareholders are allowed to transfer their ownership of share to others without the consent of other shareholdersIf the capital exceeds VND 10B, a JSC can be publicly listed at Hanoi Stock Exchange (HNX) or Ho Chi Minh City Stock Exchange (HOSE) | Can recruit employees to handle contracts and promote sales with local partnersCan find goods and services purchase opportunities, and can conduct research and develop productsLicense is valid for two to five years and can be renewed, allowing participation in investment activitiesA foreigner working at a representative office can get a work permit, a two-year multiple temporary residency visa for themselves, as well as their family in VietnamA cost-saving investment option for foreign investors with no corporate income tax, no added-value tax, no independent audit, and no financial statementEasy to shut down |

Easier for Use company Setup Service

Topa.vn provide the Company Setup Service. We will do all process for Investor include:

SERVICES FOR BUSINESS INVESTMENT

- Consulting for Setup new Company

- Investment Registration Certìicate (IRC)

- Enterprise Registration Certificate (ERC)

- Business Sub-license Registration Certificate ( BRC)

- Company Names Availability check

- Company Stamp

- Director Stamp

- Enterprise’s Information Annoucement

- Enterprise’s regulations

SERVICE FOR SETUP COMPANY

- Accounting – Bookkeeping – Tax Service

- Personal Income Tax (PIT)

- Corporate income tax (CIT)

- Value-Added Tax (VAT)

- Import and Export Tax

- Annual Licence Tax

- Tax Consulting

- Online accounting software

- HR Service

- Social Insurance Service

- Contract labor

- Salary & Benefit

OUR SERVICES FOR NEW BUSINESS INVESTMENT

For all new business investment, Topa.vn will support you all the procedure to make new Busines & Certificate, include:

- Notifying application documents required in accordance with Vietnamese law;

- Drafting application documents required for submission;

- Amending the application documents based on CUSTOMER’s comments;

- Obtaining preliminary comments from the licensing authority on the draft application documents;

- Finalizing the application documents following comments from the licensing authorities;

- Submitting the application documents to the licensing authority on CUSTOMER’s behalf;

- Monitoring and following up with the relevant authorities on the approval process;

- Keeping CUSTOMER updated on the developments and additional requirements, if any;

- Assisting CUSTOMER in obtaining Investment Registration Certificate and Enterprise Registration Certificate.

WHAT INFORMATION DO BUSINESS NEED TO PROVIDE ?

I. THE COMPANY INFORMATION

- Name of the established Company

- Vietnamese name:

………………………………………………………………..…………….……..

- English name:

……………………………………………………………………..………..…………..

- Brief name:

………………………………………………….…………………………………..…..

- The legal representative of the established Company:

– Full name…………………………………… Passport No.: ……………………………

– Title (Director/General Director): ………………………………………………..……

- Resident address (in home country):

…………..………………………………………………..

- Current address (in Vietnam): …………………………………………

– Tel: ………………………………. Email:

…………………………………..…

- The investor:

– Full name…………………………………… Passport No.: ……………………..….

- Title (Director/General Director):

…………………………………………..…………………..…

- Resident address:

…………..…………………………………………………………………….………

- Current address:

…………….………………………………………………………..…….……………..

– Tel: ………………………………. Email: ………………………………

- Business lines (detail): product/service quality testing (iso)

………………………………………………………………

5. Production: ………………………………………………………………………………..…

6. Total of employees: ………………………………………………………..…….

Number of Vietnamese employees: ………………………………………………….

Number of foreign employees: …………………………………………

- Capital:

- Charter capital: ……………..………….….VND, equivalent to……………………. $

- Total investment capital: ………………VND, equivalent to……………………. $

- Other capital: ……………….……….….….VND, equivalent to……………………. $

- Address of company: No.6, 143/99/7 Xuan Phuong Alley, Phuong Canh ward, Nam Tu Liem district

- Ratio of capital contribution of each investor:

| No. | Investor | Contributed capital | Type of assets for contributing capital | Ratio (%) |

| 1 | ………………….. $ | ………………….. $ | 51% | |

| 2 | ………………….. $ | ………………….. $ | 49% |

II. REQUIRED DOCUMENTS

Please arrange for the following document to be sent to us for our preparation of the Application Document:

| No. | Documents | Number of copies |

| 1 | Full notarized copy of passport of the (i) legal representative; (ii) the investor; (iii) the authorized representative if the investor is organization. | 03 |

| 2 | Notarized copy of Business Registration (if the investor is organization). | 03 |

| 3 | Bank account balance statement of the investors; | 03 |

| 4 | Original of Memorandum of understanding/Agreement on the lease of office/factory and notarized copies of the documents proving the lessor’s right to lease the office/factory (e.g. Business registration certificate; land use right certificate, the landlord’s approval in case of sublease, Environment Assessment etc.) | 01 original |

PROCESS AFTER BUSINESS ESTABLISHMENT

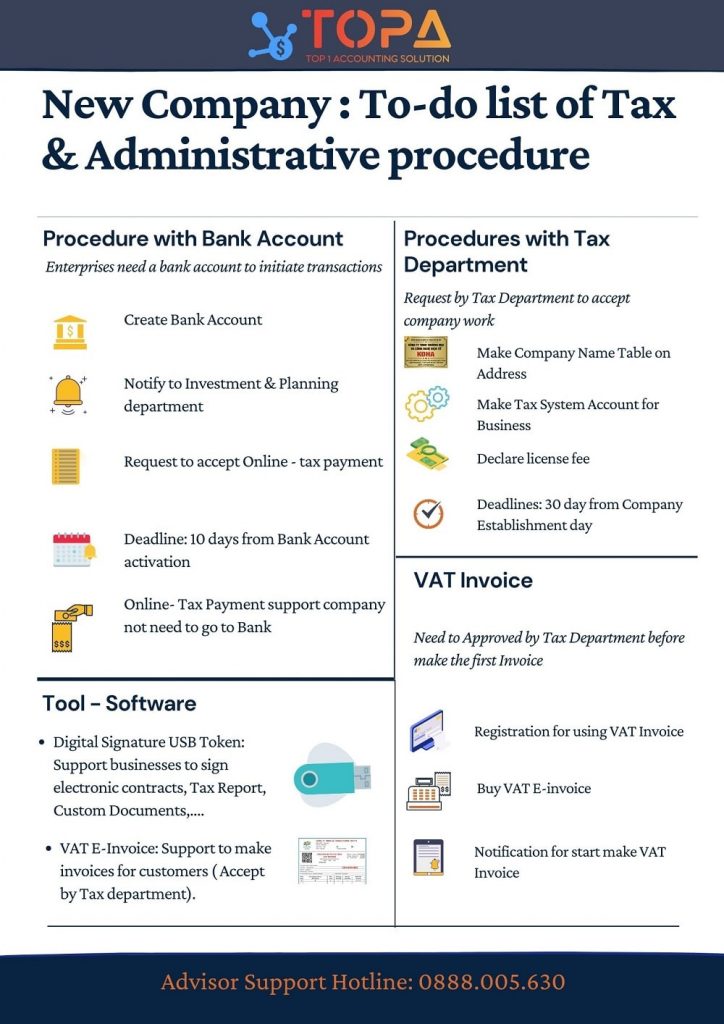

Buy Tool – Software

Vietnam is one of the most improved countries about the electronics public Service. To use that service, you need to Buy Tool- Software to support

- Digital Signature USB Token: Support businesses to sign electronic contracts, Tax Report, Custom Documents,….

- Electronics VAT Invoice: Support businesses to make invoices for customers ( Accept by Tax department). It’s not same with others country, where the VAT Invoice form make by Company

Request by Tax Department

The Tax Department in Vietnam is the administrative agency all companies don’t want to meet. So you need to completed all this process to make sure that they don’t hamper to your business:

- Make Company Name Table on Address

- Make Tax System Account for Business

- Declare license fee (New businesses are exempt from license fees on their first year)

- Registration for using VAT Invoice

- Notification for start make VAT Invoice

Bank Processes

For your payment and transaction, please use the Bank account. To accept by Public Agencies, please follow that work :

- Create Bank Account

- Notify to Investment planning department

- Request to accept Online – tax payment

ALL-IN-ONE SERVICE

For new investors want to make a business in Vietnam, the administrative procedures when starting a business are always really difficult. A lof of documents need to prepare and explain.

With a lot of experiences, we understand that investors need help about consulting & implementions. Because of that, we already make ALL-IN-ONE services for foreigners investor. Let see our scope of work:

| A) Service for New Investors ( Make a new company) |

| Consulting for all thing before start make a new CompanyCompany Name CheckCompany AddressCompany investment incentive from governmentIndustry & Business Sub-LicenseAfter Registration Process |

| Make Investment Registration Certificate |

| Make Enterprise Registration Certificate (ERC) |

| Make Business Sub-license Registration Certificate ( BRC) |

| Make VISA, Work Permit for Foreigner Employee |

| B) Service for Administrative Procedure ( After Enterprise Registration) |

| Accounting Process Set-up |

| Buy Digital Signature ( USB Token) |

| Buy VAT E-Invoice |

| Make Tax System Account for Business |

| Declare license fee (New businesses are exempt from license fees on their first year) |

| Registration for using VAT Invoice |

| Notification for start make VAT Invoice |

| Notify bank account to Investment planning department |

| Request to accept Online – tax payment |

| 15. IP/ Trademark Regítration |

| C) HR Service |

| Recruitment: Administrator / Account with record accounting data work. |

| Preparation for HR Policy, Benefit & Compensation, Salary for Party A as Vietnam Labor Law |

| Preparation for Labor contract between Party A and their employees |

| Implementation of social insurance procedures for Party A’s Employees |

| Monthly Calculating Employee Salary, bonus, allowance & PIT for Party A Employees |

| Quarterly : Preparation for PIT declaration for Party A’s Employees |

| D) Accounting – Bookkeeping Tax Service |

| Provides a copyright to use online TOPA.VN system to upload, manage documents, track tax reports, data, and books |

| Perform accounting and bookkeeping in accordance with the Law on Accounting No. 88/2015/QH13 dated November 20, 2015 and Circular Accounting For Small And Medium Enterprises No. 133/2016/TT-BTC dated August 26, 2016 |

| Prepare and submit invoice use reports quarterly to General Department of Taxation |

| Prepare and submit the annual financial reports to Ministry of Finance |

| Prepare and submit tax reports in accordance with the tax law to General Department of Taxation:Personal Income Tax (PIT)Corporate income tax (CIT)Value-Added Tax (VAT)Import and Export TaxAnnual Licence Tax- Excise Tax |

| Perform audit all reports before submit |

| E) Consulting works |

| Consulting the optimal scheme of tax payable |

| Consulting issues questions about tax, accounting |

| Warning incorrect invoices, cost is not valid, the risks can be fined, tax arrears |

| Consulting how to issue invoices, store original documents |

| Consulting about Employee Contract, allowance, incentive in accordance with Vietnam Labor Law |

| Perform the bank account notification procedures |

| Perform procedures for online tax payment service registration |

| Perform procedures for paying license tax |

| Perform the proposed procedure is to use VAT invoices |

| Perform VAT invoice issuance notification procedures |

| Issue electronic VAT invoices for client’s customers |

ABOUT US

TOPA is the accounting solution developped by Dong Hanh Technology. Start from 2012, we’re going to provide Accounting Service for FDI for 10 years.

With the experiences working with more than 100 FDI companies, we understand that investors want to have high quality support in LAW, ACCOUNTING and HR – General Affairs Service.

From customer demand, we improve our scope of work for have all-in-one Service for FDI Company.

We hope we can make the best things for you !

QUESTIONS & ANSWER

Process to Set up a company in Vietnam?

Here’s the only Vietnam company formation guide you’ll ever need.

What does the Vietnamese company formation process look like?

We will help you apply for an Investment Registration Certificate (IRC) and an Enterprise Registration Certificate (ERC) and once they have all been issued, your Vietnamese company is operational. At first, you will send us a scanned copy of passports and other details on a director and shareholders, capital amount, company names, business activities, company address. We will check if your proposed company names and business activities are available before preparing all draft application documents. We will have the draft application documents sent to you via email. You will have them printed out, signed and returned to us together with other documents prepared by you (notarized copies of passports, proof of funds, and proof of company address). We will check and establish an application file before filing it to a relevant Department of Planning and Investment (a local government agency of a city/ province that registers Vietnamese companies).

What is an Enterprise Registration Certificate (ERC)?

It is a legal document that every Vietnam company must-have. It states all the particulars of your Vietnam company. It is issued by a provincial Department of Planning and Industry (DPI) without a set validity period.

Do I need a company address in Vietnam?

Yes, of course. All Vietnamese companies must have a local registered address. If you don’t have one already, use our virtual address service. We will help you handle your incoming letters, scan and store them in your TOPA LAW account so you have easy access to all your documents.

What is an Investment Registration Certificate (IRC)?

It is a legal document that every foreigner or foreign company must obtain when they want to incorporate a new company in Vietnam. Its term of validity is usually less than 50 years and can be renewed upon its expiry, except for certain special cases where the term could be up to 70 years. You are not required to apply for an Investment Registration Certificate (IRC) if you acquire shares/ owners’ equity in an existing Vietnam company. In such a case, you must obtain a prior written approval for such acquisition from the local Department of Planning and Investment (DPI).

How long does it take a foreigner to establish a company in Vietnam?

Once all the applications and supporting documents are ready and in order on our end, it usually takes us about 3 weeks in total to set up a Vietnam company. The breakdown of the timelimit is as follows: the first 2 weeks for obtaining an Investment Registration Certificate (IRC) and another 1 week to get an Enterprise Registration Certificate (ERC). The sooner you provide us with the required details and documents, the sooner you will be able to form a company in Vietnam. The starting point of the timelimit much depends on the availability of the the details and documents to be provided by you.

What is the minimum amount of capital required to form a company in Vietnam?

There is no requirement on the minimum amount of capital to set up a company in Vietnam, except for certain business activities that requires a legal capital. For instance, a real estate company must have a registered capital of VND 20 billion or more. We will advise you about the minimum capital on a case-by-case basis. If you want to decrease or increase the capital amount in the future, TOPA will advise if so required.

Is it compulsory to have a local shareholder for a Vietnam company?

No, it is not, except for certain business activities that require the certain percentage of local ownership in Vietnam companies.

Is it required to have a local director for a Vietnam company?

No. You don’t need to have any local director in order to form a company in Vietnam.

Must a foreigner visit Vietnam to incorporate a Vietnam company?

Not at all! You can remotely handle Vietnam company incorporation by way of hiring TOPA for the purpose. All you have to do is to provide us with all company details as well as documents in hard copy as so advised by TOPA.

Is it mandatory to open a corporate bank account in Vietnam?

Yes, of course. Your Vietnam company must open a “foreign direct investment account” at a Vietnam bank to receive your capital contribution. It also must open a VND current account as well.

Will my Vietnam company get personalized support from TOPA?

Engaging TOPA to incorporate a company in Vietnam will get you dedicated support (24/7) from qualified lawyers and professionals assigned to you. Our seasoned staff will help you handle all Vietnam company incorporation issues on a case-by-case basis. After the Vietnam company incorporation, TOPA could further assist you in proceeding with any additional registration if so required by law.

Does TOPA provide Vietnam company secretary services?

Yes, we do. TOPA does provide Vietnam company secretary services to its clients as part of its consulting services. Unlike other jurisdictions, a company in Vietnam is not required to appoint a qualified company secretary. We can handle your Vietnam company’s statutory compliance matters by informing the shareholders and the director of the Vietnam company about due dates as well as maintaining statutory registers, company documents and preparing corporate documents if so required.

Will a compulsory registration of change to corporate matters take a long time?

No, it will take not that much time if you hire TOPA LAW to help you proceed with the registration. When you want to register a mandatory change to your company’s Investment Registration Certificate (IRC) or Enterprise Registration Certificate (ERC), send relevant details to us and we will do the rest for you.

Is a Vietnam company allowed to hire foreigner professionals?

Yes, it is. A Vietnam company can hire foreign employees as long as they can qualify for a Vietnam work permit or Vietnam work permit exemption under Vietnamese laws.

Are there other post-incorporation issues a foreign owner should be aware of?

Make a company stamp and file a notice of stamp sample with the relevant Department of Planning and Investment Conduct the initial tax registration with the local tax authority Open your Vietnam company’s bank accounts, i.e. a foreign direct investment account, VND current accounts and current accounts in other currencies File a notice of such corporate account details with the local Department of Planning and Investment Inject the registered capital into the foreign direct investment account within 90 days of the incorporation date Make a company sign (company name, tax code & address are required) Apply for sub-licenses, if your business activities requires them Apply for Vietnam investment visa or Vietnam working visas for you and foreign employees Prepare and file periodic tax returns, annual financial statements Pay taxes, if any (CIT, PIT, VAT, fixed annual license tax) Make compulsory insurance contributions in Vietnam And other tasks as the case may be

How much time is required to incorporate a Vietnam company?

It takes us 3 weeks to help you form a Vietnam company. The breakdown of the timelimit is as follows: the first 2 weeks for obtaining an Investment Registration Certificate (IRC) and another 1 week to get an Enterprise Registration Certificate (ERC). However, the starting point of the timelimit much depends on the availability of the the details and documents to be provided by you.

After incorporating a Vietnam company for us, will you support us with the compliance or periodic filing issues?

Yes, of course. Upon registering a Vietnam company with TOPA LAW, we will free advice about relevant periodic compliance issues, mandatory filings as well as corresponding due dates. You will receive emails or notices from us.

Is it possible for a foreigner or a foreign company to hold 100% shares in a Vietnam company?

Yes, it is. 100% foreign ownership is allowed for most business activities, except for certain ones that require certain percentage of local ownership in Vietnam companies. We will advise you about this respect on a case-by-case basis.

What is a Limited Liability Company in Vietnam?

A large majority of foreign-invested companies formed in Vietnam are in the form of the limited liability company. It is ideal for foreigners who want the benefits of limited liability but keep the flexibility of a traditional partnership. Besides, the form of the single-member limited liability company facilitates foreign companies wishing to establish a company in Vietnam with 100% control.

What is a Joint-Stock Company in Vietnam?

This is also a common company structure for foreign owners in Vietnam because it allows the sharing of profits between shareholders as well as keep shareholders restricted from financial liability. The shareholders will only bear responsibility for the Vietnam company’s debts and financial obligations to the extent of their shares and thus, their personal assets will be protected. In addition to various ways of fundraising such as debts/ loans, and private equity (PE) fundraising that a Limited Liability Company can do, a Joint-Stock Company can raise funds by selling stock in public offerings (initial public offering (IPO), secondary public offering).

How many Directors are required for a Limited Liability Company (LTD)/ Joint-Stock Company (JSC)?

Only 1 Director and you can hire as many Deputy Directors as you deem necessary. The Director is not required to be a local person and must be at least 18 years of age or above. Vietnamese citizens or foreigners can hold this position.

What is the Vietnam Company Formation?

When incorporating a company in Vietnam, you create a legal entity that has certain rights and obligations under Vietnamese laws. It has a distinct identity from its shareholders. The process of Vietnam Company Formation always has two steps: registration of investment project (to obtain an Investment Registration Certificate) and registration of Vietnam company (to obtain an Enterprise Registration Certificate).

Can a foreigner be a director and a shareholder of a Vietnam company?

Yes, of course. Like other jurisdictions, Vietnam permits foreigners to become shareholders and directors of companies established in Vietnam. As a foreigner, you can be the only director or hire another person to hold the position. There is no requirement to have any local directors. You can be a shareholder as well. A Vietnam company must have at least 1 shareholder (and as many as 50) if it is a limited liability company or at least 3 shareholders if it is a joint-stock company. A shareholder can be an individual or a corporate entity.

How long does it take a foreigner to establish a company in Vietnam?

Once all the documents are ready, it takes us less than three (3) weeks to set up a Vietnam company. The starting point of the time-limit mostly depends on when you are comfortable with providing all the company details, and documents in hard copy as required by us.

What is the timeline for filing of quarterly tax returns and compiled financial statements for a fiscal year?

A company in Vietnam has to prepare and file quarterly tax returns within 30 days of the end of the relevant quarter. It has also to prepare and file an audited annual financial statement within 90 days of the end of the relevant fiscal year.

What is the Fiscal Year in Vietnam?

The fiscal year in Vietnam is the fiscal accounting period of a company which is up to 12 months. In Vietnam, you can choose from four fiscal year periods:

January 1 to December 31 April 1 to March 31 June 1 to May 31 October 1 to September 31

What is an annual financial statement in Vietnam?

By April 1 each year, companies in Vietnam must file their annual financial statements of the previous year. An annual financial statement must include:

Balance sheet Profit & loss report Cash flow report Note of financial statement

Of note, an annual financial statement of a foreign-owned company must be audited by an independent auditing company licensed to operate in Vietnam. The accounting records must be kept in the currency of VND and written in Vietnamese.

What are the deadlines for the most important tax and legal compliance in Vietnam?

Deadlines for tax declaration and payment Deadline for filing of annual audited financial statements Deadline for filing of statistics reports Deadline for filing of FDI reports Deadline for filing of labor-and-salary-related reports

What happens if you don’t meet compliance deadlines in Vietnam?

Failure to do this can result in a fine or non-monetary penalties imposed by the relevant State agencies. The seriousness of your breach will partly depend on the number of days during which the filings are delayed.

How to file tax returns and annual financial statements?

All foreign-invested companies incorporated in Vietnam have to file their tax returns and audited annual financial statements using softwares licensed by the General Department of Taxation of Vietnam.

Does TOPA supply bookkeeping, accounting, payroll, taxation, and auditing services?

Yes, of course. TOPA is an active member of a unified group consisting of a law firm, a bookkeeping & accounting company, and an auditing company. We do provide these services at very competitive prices. We have built a strong client database and they are completely pleased with the readiness and quality of our services.

Why do I need to outsource the accounting tasks?

For the following reasons:

You are an expert in your own industry and very unlikely have experience and training as our accountants You will have time to focus on what you are good at You can save up to 35% of the costs in comparison of the cost of hiring a full-time accountant You can minimize the risk of making mistakes when preparing accounting reports You can get valuable accounting & tax advice from us We can help you lower your tax burden because our accountants have many years of experience and training

Is it safe to outsource my tax-reporting & accounting tasks?

You have to select a trustworthy Vietnam tax-reporting & accounting service provider, like TOPA. You will have more time and save more money when you don’t have to hire and train your employees to be an accountant for your Vietnam company. Our team of seasoned accountants at TOPA LAW helps you submit accurate and timely reports. We always use the latest licensed accounting software to process your reports and data securely confidentially.

Can my Vietnam company remit funds from Vietnam to other countries?

Yes, of course. It is possible to send money overseas from Vietnam in many legal ways, such as for payments for legally imported goods, services provided abroad, repayment of loans or interest on the loan, payment of dividends, and disposal of capital. The appropriate documentation proving the remittance purpose must be duly obtained and presented to your bank in Vietnam.

Are there any donations that are accepted by the Vietnam tax authority as deductible expenses?

Yes, there only are certain types of donations that are accepted as deductible expenses, i.e. those for education, health care, natural disaster or building charitable homes for the poor or for scientific research. Such deductible expenses must be properly supported by appropriate documentation (including bank transfer slips where the invoice value is VND20 million or more).

Can I and my family members obtain residence cards to live and study in Vietnam?

Under the new law on immigration which became effective on July 1st, 2020, foreign shareholders who invest VND 3,000,000,000 (around US$ 130,000) or more into their Vietnam company can get a 2-3 year Temporary Residence Card which also can be renewed afterward. In addtion, they can obtain Temporary Residence Cards for their dependants. For those who invest less than such amount, they can only obtain 1-year investment visa and cannot obtain 1-year visas for their dependants. It will take us about 1 week to get a Temporary Residence Card.

Can I move to Vietnam if I have a company there?

Yes, you absolutely can. Your Vietnam company can sponsor your Vietnam Investment Visa or Vietnam Working Visa. Upon obtainment of the Vietnam Investment Visa or Vietnam Working Visa, you may apply for a Temporary Residence Card (TRC) and it can be renewed upon its expiry. This Temporary Residence Card (TRC) will also serve as a long-term visa as well.

Can I transfer the Work Permit Exemption and Temporary Residence Card I have to my new Vietnam company?

No, you cannot. Work Permit Exemption and Temporary Residence Card are issued per one specific company. You can only work for an employer (your Vietnam company) that has sponsored your visa.

Do I need a Vietnam Work Permit to work for my Vietnamese company?

No, you don’t. An individual shareholder like you does not need to obtain a Vietnam work permit to work for your Vietnamese company. However, you need to apply for a Vietnam Work Permit Exemption instead. It’s a type of special Vietnam working visa issued to foreign shareholders of Vietnamese companies. It allows you to work exclusively for your company. It’s valid for 1 to 2 years and can be renewed afterward.

What is a Vietnam Work Permit Exemption?

If you are a shareholder of a Vietnam company, you are not required to apply for a Vietnam Work Permit to work for your Vietnam company. Instead, you must apply a Vietnam Work Permit Exemption with the term of up to 2 years and can be renewed upon its expiry.

In what case does a foreigner have to obtain a Vietnam Work Permit?

Your Vietnamese company must obtain Vietnam Work Permits for any other foreigners who work for your Vietnamese company, except for cases where such employees are also exempt from Vietnam Work Permits as well (in that case, they must obtain Vietnam Work Permit Exemptions instead).

What is a Vietnam Investment Visa?

It’s a type of investment visa just issued to a foreign shareholder of a Vietnam company whose name appears on an Investment Registration Certificate (IRC) or an Enterprise Registration Certificate (ERC).

What is a Vietnam Working Visa?

It’s a working visa sponsored by a specific Vietnam company so it enables such a company to invite foreign professionals to enter Vietnam and work for the inviting company. It allows you to work exclusively for that company, live and bring your family to Vietnam. Its duration is determined by the length of the labor contract but in any case, no more than two (2) years long.

What are the requirements to get a Vietnam Working Visa?

If you are a shareholder of a Vietnam company, you must obtain a Vietnam Work Permit or Vietnam Work Permit Exemption before applying for a Vietnam Working Visa. If you are not a shareholder and want to work for a specific Vietnam company, you must have an offer of employment to fill a genuine job vacancy of that Vietnam company. The sponsoring company must apply for a Vietnam Work Permit for you before you can obtain a Vietnam Working Visa. In order to get a Vietnam Work Permit, you need to qualify for the job, which means your health, background, experience, and education in the relevant field and clean criminal record must meet the requirements of the Vietnamese laws.